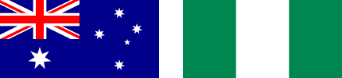

Top 10 Nigerian Startups to Watch in 2026

Nigeria’s startup scene is experiencing explosive growth, making it one of Africa’s most exciting investment destinations. For Australian investors seeking

Australia’s trusted bridge to Nigeria’s most ambitious opportunitiess

For the Australian investor accustomed to the ASX, the Nigerian Stock Exchange (NGX) represents a gateway to one of Africa’s largest and most dynamic economies.

Located in Lagos, the NGX, formerly the Lagos Stock Exchange, is a key player in the continent’s financial landscape.

While smaller and more volatile than developed markets, it offers a ground-floor opportunity in a nation with a burgeoning population and significant economic reforms underway.

Understanding the NGX is the first step for any Australian looking to diversify their portfolio into a high-potential frontier market.

To make informed decisions as an Australian investor, it’s essential to know which parts of the Nigerian economy are driving market growth. The performance of the Nigerian Stock Exchange (NGX) is largely powered by three key sectors: Financials, Industrial Goods, and Technology.

The banking sector is the engine room of the Nigerian economy. As the most liquid and actively traded segment on the NGX, Nigerian banking stocks serve as a reliable indicator of the nation’s overall economic health.

Recent policies from the Central Bank of Nigeria, such as new recapitalisation requirements, are pushing banks to become larger and more resilient. This is expected to boost long-term profitability and stability. Investing in major banks like Zenith Bank or FBN Holdings offers a direct way to gain exposure to Nigeria’s commercial activity.

Nigeria is experiencing a massive demand for infrastructure, from new roads to commercial and residential property. This makes the industrial goods sector, especially cement production, a powerful area for investment.

Companies in this space benefit directly from government infrastructure projects and private-sector construction. Industry giants like Dangote Cement and BUA Cement are central to this national development. Their stock performance is directly linked to the physical growth and urbanisation of the country, offering investors a tangible stake in Nigeria’s future.

Home to one of Africa’s largest mobile markets, Nigeria has a rapidly expanding digital economy. This growth is driven by telecommunication leaders providing essential data and voice services that underpin modern commerce.

The potential for growth in fintech, e-commerce, and other digital services is enormous. Companies like MTN Nigeria and Airtel Africa are foundational platforms for this digital transformation. Investing in these Nigerian tech stocks to watch allows you to tap into the country’s ongoing technological revolution.

Australian investors often seek international diversification to mitigate risk and capture growth not available domestically. Nigeria, with its population of over 200 million people, presents a compelling, albeit high-risk, long-term growth story.

The Nigerian economy growth narrative is powered by a youthful demographic, increasing urbanisation, and a growing consumer class.

Recent economic reforms, including changes in foreign exchange policy and fuel subsidies, have been designed to attract foreign capital and stabilise the economy.

These shifts, while causing short-term volatility, signal a move towards a more market-friendly environment, making it an interesting time to explore investing in Nigeria from overseas.

The NGX All-Share Index performance has often reflected this underlying potential, showing periods of substantial growth that can significantly outperform more mature markets.

Disclaimer: The following information is for investigational and informational purposes only and does not constitute financial advice. Stock performance is subject to market volatility and economic conditions. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Identifying high-growth Nigerian stocks means focusing on companies with strong market positions and clear growth catalysts. Below are some of the key players that have historically been among the Nigerian stock exchange top gainers.

As the Nigerian financial sector undergoes recapitalisation, larger, well-established banks are positioned to strengthen their market leadership.

Zenith Bank PLC: One of Nigeria’s most profitable banks, known for strong governance and consistent dividends. Its robust digital banking platform is a key growth driver.

FBN Holdings (First Bank): A financial powerhouse with a long history and one of the most extensive branch networks in the country.

These companies are central to Nigeria’s ambitious infrastructure and construction goals, making them a direct investment in the country’s physical development.

Dangote Cement: The undisputed market leader in Nigeria and across Africa. Its massive production capacity gives it a significant competitive advantage, and its stock is often seen as a proxy for the entire construction sector.

BUA Cement: A major competitor to Dangote, rapidly expanding its operations to meet the country’s high demand for building materials.

These companies provide the essential infrastructure for Nigeria’s booming digital economy, with growth driven by data consumption and financial technology.

MTN Nigeria: The country’s largest mobile network operator. Growth is increasingly powered by its data services and its expansion into fintech with the MoMo payment service bank.

Airtel Africa: A key player with a large presence in Nigeria and across the continent. Its focus on expanding 4G coverage and growing its mobile money business makes it compelling.

Nigeria’s energy sector is undergoing a major transformation, offering unique opportunities for investors.

Geregu Power: The first power generation company listed on the NGX. It represents a ground-floor opportunity to invest in solving Nigeria’s long-standing power supply challenges, holding immense growth potential as the sector develops.

For an Australian, the process of investing in the Nigerian stock market may seem complex, but it can be broken down into manageable steps. The key is to work with the right intermediaries who can facilitate cross-border investments.

This is the most important step. You have two main options. The first is to use a large international broker that offers access to frontier markets, including Nigeria. The second, and often more direct, option is to engage one of the established stockbrokers in Nigeria for foreigners. Many Nigerian brokerage firms have systems in place to onboard international clients. Research firms that are members of the NGX and have a good reputation for serving a global clientele.

Once you’ve chosen a broker, you will need to open an account. This involves a Know Your Customer (KYC) process, which is a standard anti-money laundering requirement globally. You will likely need to provide identification documents such as your Australian passport, proof of address (like a utility bill), and possibly a bank reference letter. The broker will guide you through their specific requirements.

Funding your account involves an international wire transfer from your Australian bank account. The most significant consideration here is currency exchange. You will be converting Australian Dollars (AUD) to Nigerian Naira (NGN). It is vital to understand the exchange rate you will receive and any associated fees. Your broker can advise on the best method for this transfer. This is where the foreign exchange risk Nigeria becomes a practical reality.

After your account is funded, you can start placing trades. Your broker will provide a platform or a method for you to submit buy and sell orders for the stocks you have researched. You can then begin building your portfolio of top Nigerian stocks, monitor their performance, and manage your holdings just as you would with an Australian portfolio.

While the NGX offers high growth potential, Australian investors must be aware of a unique set of risks. Understanding these factors is key to successful investing.

The single biggest risk is the fluctuation of the Nigerian currency.

Volatile Exchange Rate: The Nigerian Naira (NGN) can experience significant and rapid value changes against the Australian Dollar (AUD).

Impact on Returns: A sharp fall in the Naira can erase your profits, even if your stock’s price goes up in its local currency.

The Bottom Line: Your final return is determined by the exchange rate when you convert your funds back to AUD. This foreign exchange risk is a primary consideration for any Naira investment.

The NGX has lower trading volumes than the ASX, which leads to two distinct challenges.

Lower Liquidity: It can be difficult to buy or sell large quantities of stock without affecting the share price.

Higher Volatility: This lower liquidity results in sharper and more frequent price swings. Investors need to be prepared for this by adopting a long-term investment horizon.

As an emerging market, the NGX is highly sensitive to local events and the country’s economic health.

Key Factors: The market is heavily influenced by government policy changes, inflation rates, and overall political stability.

Stay Informed: The Nigeria economic outlook can change quickly. It is essential for Australian investors to stay informed about the broader macroeconomic and political landscape to understand the context of their investments.

The Nigerian Stock Exchange presents a compelling frontier for Australian investors seeking diversification and high-growth opportunities outside of traditional markets.

Sectors like banking, industrials, and technology are powered by the country’s strong demographic tailwinds and ongoing economic reforms.

While the potential for substantial returns exists, it is matched by significant risks, particularly concerning currency volatility and market liquidity. A successful investment journey requires thorough research, a long-term perspective, and a clear understanding of the local context.

For the prepared and diligent investor, Nigeria offers a chance to participate in one of Africa’s most promising growth stories.

Identifying a single “best” stock is difficult as it depends on an investor’s risk appetite and goals. However, blue-chip stocks in key sectors like banking (e.g., Zenith Bank), industrial goods (e.g., Dangote Cement), and telecommunications (e.g., MTN Nigeria) are often considered foundational holdings. These companies are market leaders with a history of strong performance and are deeply embedded in the Nigerian economy growth story.

Profitability can be measured by stock price appreciation or dividend yield. Historically, some of the best dividend stocks Nigeria offers come from the banking sector. In terms of capital gains, top performers can vary year by year, often including companies from the financial, industrial, or energy sectors that have benefited from positive economic news or strong earnings reports. Reviewing the NGX All-Share Index performance can provide insights into which stocks are driving market gains.

A foreigner, including an Australian resident, can invest by opening an account with a licensed Nigerian stockbroking firm that services international clients. The process involves completing a KYC (Know Your Customer) procedure, obtaining a Central Securities Clearing System (CSCS) account through the broker, and funding the account via international wire transfer. Some global brokerage platforms may also offer access.

This depends on your long-term outlook. Nigeria is undergoing significant economic reforms, which have created short-term volatility but may lead to long-term stability and growth. For investors with a high tolerance for risk and a multi-year investment horizon, the current valuations in the market could present an attractive entry point to tap into the country’s future growth potential.

The list of the top 10 performing stocks changes frequently based on market dynamics. To get the most current information, it is best to consult the official website of the Nigerian Stock Exchange (NGX) or reliable financial news sources that publish daily or weekly market reports. Historically, the list often features major banking stocks, cement manufacturers, and large telecommunication companies.

The most direct way is to contact a Nigerian stockbroker who is equipped to handle international clients. You will need to provide identification and proof of address, transfer funds (AUD to NGN), and then you can instruct the broker to buy shares on your behalf. The process is similar to opening a brokerage account in Australia, but with the added steps of international verification and currency conversion.

Nigeria’s startup scene is experiencing explosive growth, making it one of Africa’s most exciting investment destinations. For Australian investors seeking

For Australian investors exploring international markets, Nigeria presents a compelling, high-growth opportunity in real estate. This analysis offers a data-backed