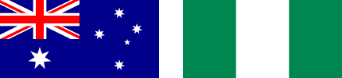

Top 10 Nigerian Startups to Watch in 2026

Nigeria’s startup scene is experiencing explosive growth, making it one of Africa’s most exciting investment destinations. For Australian investors seeking

Australia’s trusted bridge to Nigeria’s most ambitious opportunitiess

The Nigerian tech ecosystem is one of the most dynamic and rapidly growing markets in the world.

For Australian investors and entrepreneurs, it represents a significant frontier for high-growth opportunities. Securing venture capital for a tech startup in Nigeria involves understanding a unique landscape of immense potential and specific challenges.

This guide provides a clear pathway, explaining how to prepare your venture, engage with key Nigerian VC firms, and navigate the financial and legal considerations from an Australian viewpoint, helping you tap into this vibrant market.

Before seeking tech startup funding in Nigeria, it is vital to grasp the context of the market. For an Australian, the scale and dynamics can be vastly different from what you are used to.

Nigeria is Africa’s most populous country, with over 200 million people, and a median age of around 18. This creates an enormous, youthful, and increasingly tech-savvy consumer base. Internet penetration is rising rapidly, and mobile phones are ubiquitous. This combination presents a massive market opportunity in Nigeria for digital products and services. Problems that affect millions can be solved with technology, allowing startups to scale at a pace that is difficult to achieve in smaller, more saturated markets like Australia. The potential for a single successful venture to capture a large user base is a primary driver for foreign investment in Nigeria tech.

Certain sectors in Nigeria have become hotspots for venture capital due to their potential to solve pressing local problems.

Lagos is the epicentre of the Nigerian tech ecosystem. The Lagos tech hub in the Yaba area is home to countless startups, incubators, and VC offices. However, the ecosystem is decentralising. Cities like Abuja (the capital), Ibadan, and Port Harcourt are developing their own tech communities. For founders and investors, this means opportunities exist outside the highly competitive Lagos bubble, sometimes with lower operational costs and access to untapped markets.

Securing venture capital in Nigeria requires understanding what local and international investors are looking for in this specific context.

Investors are looking for startups that exhibit a few key characteristics. They want businesses with massive scalability. Your idea must be able to grow to serve millions of users. They also want a strong, resilient founding team with deep local knowledge. An Australian founder partnering with a Nigerian co-founder is often a powerful combination. Most importantly, your startup must be solving a problem that is a major pain point for a large segment of the Nigerian population. Solutions that are ‘nice-to-have’ are less likely to get funded than those that are essential.

Venture capital is just one part of the funding landscape.

Before you even think about creating a pitch deck, your business needs to be investment-ready.

Your business model must be tailored to the Nigerian reality. A subscription model that works in Australia might fail in Nigeria if digital payment adoption is low among your target audience. You need to consider local purchasing power and consumer behaviour. A ‘freemium’ model or a transaction-based model might be more effective. Your business model for Nigerian startups should clearly show how you will acquire customers, generate revenue, and become profitable in a market with its own unique economic conditions.

Ideas are cheap; execution is everything. Investors want to see proof that your concept has legs. This proof is called traction. Traction for startups can take many forms: a growing list of initial users, early revenue, a successful pilot program, or a signed partnership with an established company. The more traction you can show, the less risk the investor is taking. It proves that there is real demand for your solution.

A generic business plan will not work. You need to show a deep understanding of the local market. Your financial projections must account for local factors like inflation rates, potential currency fluctuation in Nigeria, and local salary benchmarks. Demonstrate that you have thought about the operational realities, such as the cost of running a generator for backup power or navigating complex logistics. This level of detail shows investors you are serious and well-prepared.

Your pitch deck is your introduction to investors. It needs to be clear, compelling, and convincing.

Your pitch deck for Nigerian startups should be a concise and visual story about your business. Include these key slides:

When pitching to Australian investors Africa tech opportunities, you may need to add extra context. Do not assume they understand the market dynamics. Explain the ‘why Nigeria’ part very clearly. Use data and analogies they can relate to. Frame the problem and solution in a way that highlights both the local impact and the global investment potential. Be prepared to answer detailed questions about risk and how you plan to mitigate it, as this will be a top concern for any prudent foreign investment professional.

Fundraising is a journey that happens in stages, with expectations increasing at each step.

Seed funding is the earliest round of institutional investment. The goal of seed funding for Nigeria tech startups is to help a company achieve product-market fit. At this stage, investors are betting heavily on the founding team and the size of the market opportunity. You need a compelling vision, a minimum viable product (MVP), and some initial traction. Capital raised is typically used to hire key staff, refine the product, and begin acquiring customers.

Series A funding is about scaling. By the time you are ready for Series A funding in Nigeria tech, you should have a proven business model, a solid user base, and predictable revenue streams. Investors will want to see detailed metrics on customer acquisition cost, lifetime value, and churn. The capital raised in a Series A round is used to expand the team, grow market share, and potentially enter new markets. This is where the business starts to accelerate seriously.

Knowing who to pitch to is just as important as having a great pitch.

The ecosystem of Nigerian VC firms is growing. Some of the most active players include:

Angel investor networks in Nigeria are a fantastic resource for early-stage founders. The Lagos Angel Network (LAN) is one of the most prominent. These networks pool the resources and expertise of individual investors, making it easier for startups to connect with potential backers for that critical first round of funding.

Startup accelerators in Nigeria can provide a significant boost. Programs like Co-Creation Hub (CcHub) in Nigeria, as well as international accelerators like Y Combinator and Techstars that are very active in the country, offer mentorship, resources, and often a small seed investment in exchange for equity. Graduating from a reputable accelerator adds a stamp of credibility that can make future fundraising easier.

For Australian founders or investors, there are specific considerations when engaging with the Nigerian market.

The regulatory environment in Nigeria can be complex. It is essential to engage a reputable local law firm to help with company registration, intellectual property protection, and ensuring compliance with all regulations. Understanding the legal framework for equity financing in Nigeria is vital to structuring a deal correctly. While there can be bureaucracy, the government is actively working to make the environment more friendly for tech startups.

The Nigerian Startup Act is a landmark piece of legislation designed to support the tech ecosystem. For startups that receive a “startup label,” the Act provides benefits like tax breaks, access to a dedicated government funding pool, and regulatory relief. For Australian investors, this Act provides a degree of formal structure and support from the government, which can help de-risk an investment. It signals a strong government commitment to the tech sector’s growth.

One of the biggest concerns for any foreign investor is currency risk. The Nigerian Naira (NGN) can be volatile against the Australian Dollar (AUD). This currency fluctuation in Nigeria can impact the value of your investment and eventual returns. Investors often try to structure deals in a stable currency like the US Dollar where possible, though this is subject to local regulations. Another key area is the repatriation of funds from Nigeria. You must understand the Central Bank of Nigeria’s policies on moving profits and capital out of the country. Again, local financial and legal advice is indispensable here.

Conducting due diligence in Nigeria while being based in Australia requires a structured approach. You will need a team on the ground. This could be a local lawyer and an accountant. They can help verify a startup’s claims, check their financial records, and confirm their legal standing. You should also conduct extensive reference checks on the founders. Use video calls extensively to build a relationship with the team and ask tough questions. While it is an extra layer of work, thorough due diligence is non-negotiable.

While the opportunity is vast, it is important to be realistic about the hurdles.

Unreliable power and inconsistent internet are realities in Nigeria. Investors will expect you to have a plan for this. Your business plan and financial model should include the costs of backup generators, solar power, and multiple internet service providers. Framing this not as a problem but as a cost of doing business that you have planned for shows foresight.

There are many talented founders in Nigeria competing for a limited pool of venture capital. Your startup needs to stand out. This means having a stronger team, more traction, or a more compelling vision than your competitors. A clear, well-articulated unique selling proposition is essential.

If you are not based in Nigeria, building the necessary relationships can be a challenge. You need to be proactive. Attend virtual events focused on the African tech scene. Use platforms like LinkedIn to connect with investors and other founders. When possible, plan trips to Nigeria to meet people in person. Trust is a huge component of investment decisions, and it is often built through face-to-face interaction.

Raising venture capital for a tech startup in Nigeria is a challenging but achievable goal. For Australian entrepreneurs and investors, the market offers unparalleled growth potential. Success requires a deep appreciation for the local context, a meticulously prepared business, and a strategic approach to engaging the investor community.

By understanding the ecosystem, preparing for the unique challenges, and building strong relationships, you can effectively navigate the path to securing funding. The Nigerian tech revolution is well underway, and with the right approach, Australian ingenuity and capital can play a meaningful part.

To get venture capital in Nigeria, you need a scalable tech startup with a strong team and proven market demand. The process involves creating a solid business plan and pitch deck, demonstrating early traction for startups, and networking to connect with Nigerian VC firms and angel investors. Building relationships and showing you understand the local market opportunity in Nigeria are key.

To attract investors, focus on solving a significant problem for a large Nigerian audience. Show impressive traction for startups, whether it is user growth or early revenue. Have a clear and defensible business model. A strong founding team with local expertise is highly attractive. Networking within the Lagos tech hub and other ecosystems, both online and in-person, is essential to get on investors’ radar.

While there are no shortcuts, the fastest way often involves joining a reputable startup accelerator in Nigeria. These programs provide a small amount of seed funding and connect you directly with a network of investors. Another fast route is securing funding from angel investors, who can often make decisions more quickly than larger venture capital funds. Having all your documents—pitch deck, financial model, and business plan—ready is also vital to speed up the process.

The main challenges of raising VC in Nigeria include intense competition, investor focus on a few key sectors like Fintech Nigeria, and infrastructural issues that can increase operational costs. For foreign founders, navigating the regulatory environment in Nigeria and building trust without a physical presence can also be difficult. Currency fluctuation in Nigeria is another significant risk for international investors.

The Fintech Nigeria sector consistently attracts the most foreign investment. The massive opportunity to provide financial services to the country’s large and underbanked population has made it a magnet for venture capital. Following fintech, sectors like e-commerce, logistics, healthtech, and agritech are also gaining significant investor interest.

Foreign investors, including those from Australia, can invest by wiring funds directly to a registered Nigerian company after completing legal documentation. It is common to work through local legal and financial advisors to handle the due diligence and ensure compliance. Investing alongside reputable Nigerian VC firms or through syndicates are also popular methods. Understanding the rules around repatriation of funds and the protections offered by the Nigerian Startup Act is important for a smooth investment process.

Nigeria’s startup scene is experiencing explosive growth, making it one of Africa’s most exciting investment destinations. For Australian investors seeking

For Australian investors exploring international markets, Nigeria presents a compelling, high-growth opportunity in real estate. This analysis offers a data-backed